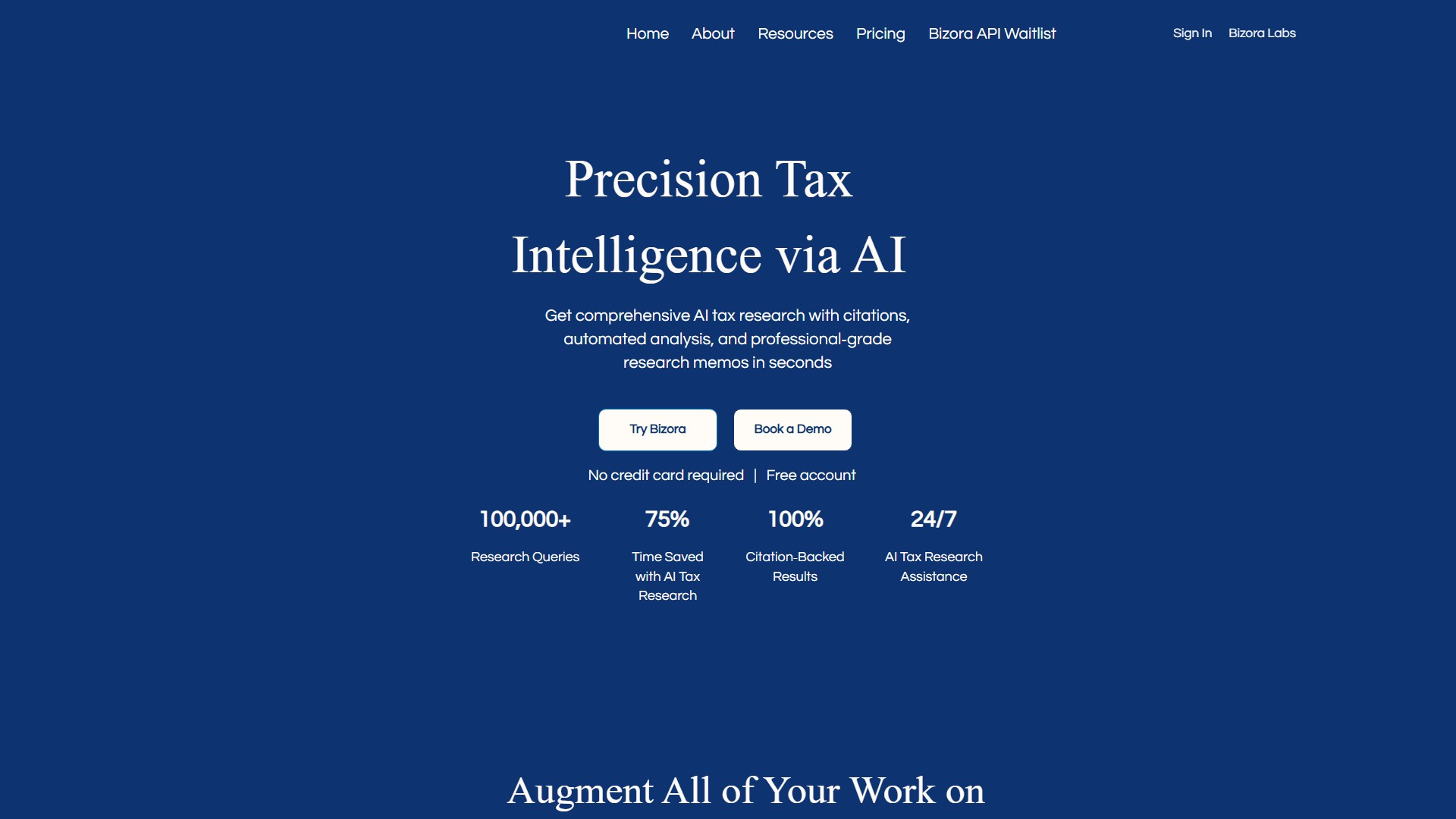

Bizora Inc.

Core Features

Instant Tax Research

Bizora delivers partner-level AI tax research in seconds with complete source transparency. Every tax research query includes precise citations from current tax codes, regulations, and case law.

Step-by-Step Transaction Playbook

Bizora's AI platform guides users through every stage of M&A transactions and complex tax planning with structured workflows, compliance checklists, and strategic insights.

Automated Document Parsing

Drop any file (Word, PDF, Excel) and Bizora's AI instantly extracts relevant tax provisions, financial data, and compliance requirements.

Global Reach & Compliance

Covers international tax regulations across multiple jurisdictions, including U.S. federal tax, state tax implications, and cross-border M&A transactions.

Target Users

- CPA Firms looking to scale research and reduce compliance time

- Private Equity and Venture Capital firms navigating M&A structuring

- In-house tax teams seeking faster, more accurate analysis

- Software platforms looking to embed AI tax capabilities via API

Key Advantages

- 100,000+ Research Queries supported

- 75% Time Saved with AI Tax Research

- 100% Citation-Backed Results

- 24/7 AI Tax Research Assistance

- Bank-level encryption protects all client data

- Enterprise-grade SOC 2 compliant infrastructure

Pricing Model

Early access is free until October 15, 2025. The AI Assistant will always remain free, with API and premium features available for enterprise teams. Custom workflows can be added at any time.

Security & Compliance

- SOC 2-compliant infrastructure

- No storage of sensitive input data

- Encrypted data pipelines

- Custom compliance documentation on request

Supported Jurisdictions

Supports all 50 U.S. states, U.S. federal tax, select treaty-partner countries, and OECD/EU VAT frameworks. Coverage expands monthly.

Traffic Analysis

Last Updated 2025-12

Comment